Introduction

In the realm of speech-language pathology, practitioners often rely on data-driven decisions to enhance therapy outcomes for children. Similarly, in the field of economics, data-driven research can provide insights into improving economic stability and growth. A recent study titled "Commodity Currency Reactions and the Dutch Disease: The Role of Capital Controls" offers valuable findings that can guide economic practitioners in mitigating adverse effects associated with commodity price fluctuations.

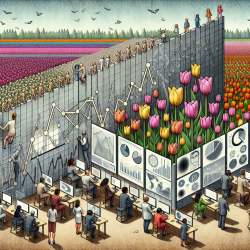

Understanding the Dutch Disease

The Dutch disease refers to the negative economic impact that occurs when a country's currency appreciates due to a commodity boom, making other sectors less competitive. This phenomenon can lead to a lack of economic diversification and hinder sustainable growth. The study in question examines whether capital controls can mitigate the transmission of commodity price changes to the real exchange rate, thereby protecting manufactured exports.

Key Findings

The research analyzed data from 37 commodity-rich countries over four decades, revealing that capital controls can play a significant role in reducing real appreciation pressures. The study found that countries with stricter capital controls experienced less severe impacts of the Dutch disease. This suggests that countercyclical capital controls—tightening during booms and relaxing during busts—can foster economic diversification and stability.

Implications for Practitioners

For economic practitioners, these findings underscore the importance of implementing capital controls as a strategic tool to manage the effects of commodity price fluctuations. By stabilizing real exchange rates, countries can shield their manufacturing sectors from the adverse effects of currency appreciation. This approach not only supports economic diversification but also promotes long-term growth.

Encouraging Further Research

While the study provides compelling evidence of the benefits of capital controls, it also highlights the need for further research. Practitioners are encouraged to explore the nuances of capital control policies and their impacts on different sectors. Understanding the specific conditions under which capital controls are most effective can enhance policy-making and economic resilience.

Conclusion

In conclusion, the study on commodity currency reactions and the Dutch disease offers valuable insights for economic practitioners. By leveraging capital controls, countries can mitigate the adverse effects of commodity booms and support sustainable economic growth. For those interested in delving deeper into the research, the original paper provides a comprehensive analysis of the data and methodologies used.

To read the original research paper, please follow this link: Commodity currency reactions and the Dutch disease: the role of capital controls.